Manufacturers and distributors experienced huge supply chain disruptions due to the pandemic which exposed many vulnerabilities and tested the resilience of supply chain leaders globally. In fact, SYSPRO research revealed that 60% of businesses were impacted by supply chain disruptions during the pandemic. Industries experienced severe operational and financial consequences with issues like supply shortages, supply and demand surges, inventory shortfalls and reduced productivity.

As a result of this volatile and uncertain period many manufacturers and distributors feel as though they lost control of their business and found themselves challenged to re-establish and stabilize their supply chain networks in this new world. Businesses have had to re-think their supply chain and its KPIs (Key Performance Indicators), but more importantly the technologies that can help enable manufacturers and distributors improve their KPIs. Improving those KPIs would help them emerge stronger and more confident with supply chains that are more resilient to future disruptions.

Identifying the KPIs needed

A good way to decide which KPIs to use is to look at how the supply chain is broken down into different processes. The SCOR (Supply Chain Operations Reference) methodology has six high-level business activities that define the supply chain – plan, source, make, deliver, return, and enable. The first five define actual supply chain activities, while enable is the framework to make things happen. Another methodology is the Porter’s Value Chain Framework, which comprises of inbound logistics, operations, outbound logistics, sales, and service.

It might seem easier to select SCOR as it provides KPIs for the high-level processes as well as the lower-level processes. But you have to choose those KPIs carefully as there are over 100! Whichever KPIs are selected, it is worth creating a two or three level hierarchy as one level may be either too general, or too detailed, depending on the level of management.

Here are some KPIs to assist you to get back on track to build an agile, adaptive, and resilient supply chain into the future:

Inbound KPIs

Supplier On-time Delivery: To achieve their supply chain objectives, manufacturers must have suppliers who are at least as efficient as they are, but preferably more efficient. This measure will be based on an agreement with suppliers that includes quantities and schedules for key raw materials or items and specific delivery intervals.

Inbound Supplier Quality Levels: The quality of products produced depends heavily on the quality of products delivered by the inbound suppliers. Therefore, it is important to measure how well these suppliers meet the expected high level of quality. This is usually accomplished by using statistical sampling of all incoming materials that can produce charts to show the quality trends over time.

Manufacturing KPIs

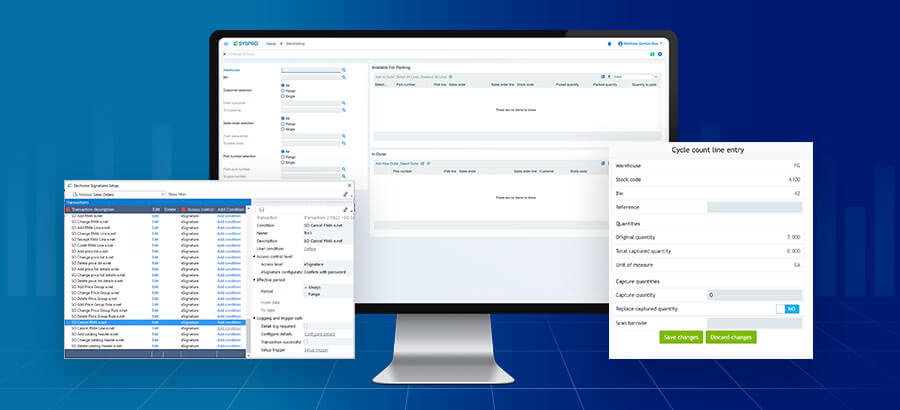

Perfect Order Performance: It is often represented as a ratio that indicates measured change against a base change value for each measured process. This is best done using an ERP system, where different steps of the manufacturing chain – order management, production, fulfilment, etc. – can be measured to define this metric.

Manufacturing Cycle Time: This metric is most accurately obtained using real-time monitoring with a Manufacturing Execution System (MES). It measures the amount of elapsed time from when an order is accepted to when the product is produced and entered into finished goods inventory.

Return Material Authorizations (RMAs): RMAs measure how many products or deliveries are returned and whether a product meets customer requirements. It is best captured in an ERP system and analyzed digitally. They are part of the quality management process and require an analysis of the top factors that drive returns to determine where interventions are required in the process.

Warehousing KPIs

Throughput (Units/Per Time Period): This is a high-level metric for warehouse efficiency and provides insight into how many units pass through a particular position, process or the whole warehouse in a fixed period. They are used to measure how effectively the warehouse processes of receiving, replenishment, fulfilment and shipping perform.

Inventory Accuracy: Ensuring inventory accuracy against the plan is critical for minimizing problems such as stock-outs and lost sales and ultimately customer satisfaction. It is also important for accurately measuring some financial KPIs. Manufacturers need to aim for an internally agreed specific percentage of stock accuracy when performing cycle counts against recorded inventory.

Capacity: Having excessive unused warehouse space wastes money but being over design capacity probably means the warehouse isn’t operating as efficiently as it could. Identifying the space versus utilization sweet spot is key. It is important to note that capacity may have seasonal or temporary variation.

Outbound KPIs

Freight bill accuracy: Whether shipping from factory to warehouse, or to the customer, this metric helps identify problems in billing operations.

On-Time Delivery in Full (OTIF): This is a primary metric of customer service and indicates how well the processes within the business perform and integrate with each other. The definition of “on-time” can vary depending on the shipping method and if partial deliveries occur but should be based upon the agreed date. Similarly, “In Full” needs to be an agreed percentage band addressing under and over quantities.

Customer KPIs

Customer Complaints/Problems: This should be a standard measurement of customer satisfaction for any business and tracked as one of the foundational KPIs. It is likely that there are multiple causes of complaints, e.g., picking inaccuracies, mis-ships, shipping damage, slow RMAs, production errors, and any other potential problem area. This metric will require investigation of specific processes and functions in order to uncover underlying issues.

Total Order Cycle Time (TOCT): As customers expect quicker delivery times, this measures the time it takes to fulfil a customer order from the time the order was received until delivered to the customer.

Financial KPIs

Metrics that track overall business performance are covered by financial KPIs. Generally, the business has its standard financial KPIs as taught to accountants, there are often some additional metrics that can be added to measure some specific areas requiring improvement. There are some additional KPIs that are worth considering:

Revenue Per Employee: This is an indicator of productivity and measures the overall contribution that the employees contribute to the business. Manufacturers need to set a base level using internal data and then measure the percentage change up or down against time.

Inventory ratios: There are several financial metrics for inventory because inventory just sitting in a warehouse has affected cash flow and in most cases, is a depreciating asset.

- Days Inventory Outstanding measures the average number of days that inventory is held before being sold.

- Inventory Turnover is a financial ratio showing how many times inventory items are sold and replaced during a given period.

- Carrying Cost of Inventory records the costs associated with purchasing and holding inventory, including labour, insurance, warehousing, and freight.

Indicators of successful inventory management are low costs and a high inventory turnover.

Profitability: This can be measured in a number of ways (e.g., Gross Profit or Net Profit) and can be done for the organization as a whole, and also by product group or by customer group.

Using KPIs to make supply chains more resilient

With the current state of flux in the world, it is important to periodically review and make changes to supply chain policies and practices if required.

Using appropriate KPIs can help identify how operational changes may affect customer service levels and profitability. This is best done by monitoring all the steps in the value chain and continually assessing how local and global conditions are changing. Their purpose is to model these changes and help predict the effects of the changes, as well as appropriate responses to these changes. This may lead to any number of follow-up actions, for example:

- Redesigning sourcing or material strategies

- Evaluate the company’s ability to maintain full production capacity based on available supplies, not just customer needs

- Re-assess safety stock levels regularly to take account of changing global conditions

- Provide supply chain status information to customers via a portal so they have visibility into your supply chain

- Increase supplier involvement and collaboration through a supplier portal. This can also be used to identify supplier problems and so take mitigating action

One of the major impacts of recent supply chain shocks is that companies have had to develop totally new supply chain models as the previous models no longer work as required. These new models must include adaptable sourcing and connected supply chain networks that can handle changing supplier issues and customer expectations. KPIs are then used to monitor the performance of the various elements of the supply chain and ensure that they all remain on track. They should identify changes and help monitor the changes ensuring that they do not stray off course and that the business stays on track.

Our advice is to not have too many KPIs, and always include a KPI to ensure that you are not going backwards. For example, if you are wanting to speed up production then have a KPI measuring throughput, but also add a KPI measuring number of defects manufactured to ensure that the process is improving and not deteriorating.