We cannot plan the project or meeting for that date, it’s month end. We definitely can’t do training now, finance is up to their ears preparing for month end. The last week and the first week of the month are no go dates as finance will be drafting financials. We don’t have that information yet, finance is still finalizing the financials for last month.

Ever heard or used any of the above statements? I can honestly say I have heard each of the above phrases many times in my career. It is always an interesting concept for me because when one looks at the benefits of an integrated system and the way technology has advanced from a reporting perspective, how is it that finance is still spending days preparing the financials?

What makes this situation even more interesting: when you analyze what is required to generate the financial reports or management packs for an organization, around 70% of the data is not even generated by the finance team. The source of financial information is often generated by other business areas such as procurement, sales, production, human resources etc.

Preparing financial statements and management packs should be repeatable, the format of display information does not change monthly. Don’t get me wrong, there are transactions and entries that only the finance team will process monthly. However, this is often a small percentage of the time needed to produce the financial results.

Let’s look at 3 possible reasons why this process could be the finance team’s enemy:

System Configuration

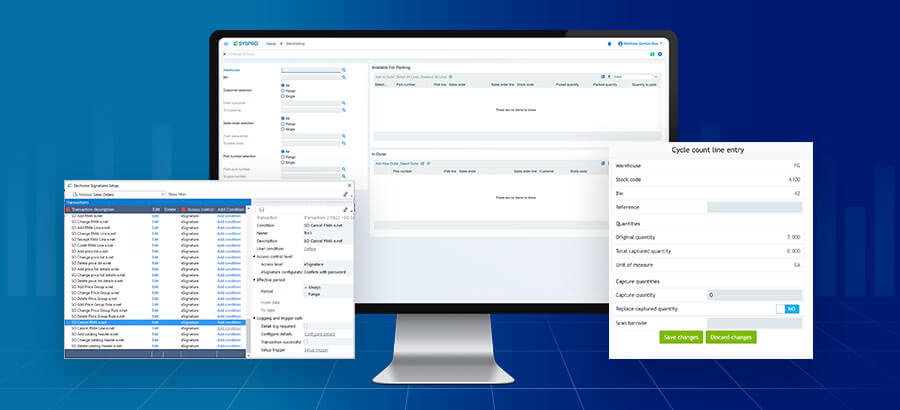

In some instances, the challenge is due to incorrect configuration of the business system. The ERP system was implemented years ago and whilst the business and reporting requirements have changed, the system has not progressed on the same journey. The design of 5 years ago no longer supports today’s requirements. This can often result in users outside of the finance team having to decide where a transaction, a purchasing expense for example, needs to be posted.

Corrections of Posting

When non-financial individuals are responsible for determining where a posting must end up in the General Ledger, one can understand how things could potentially go wrong. An individual is not always fully aware of the part they play in a business process and the impact they have on other business areas down the line. An enormous amount of time is spent by the finance team investigating postings, and then journalizing, and correcting postings to the correct account.

It is important that businesses identify the main processes that are dependent on one another, and set deadlines for each in order to avoid bottlenecks.

Cumbersome Reporting Tools

Financial reporting often requires a lot of the following to happen:

- Extracting data into a structured grouped accounts template

- Making sure the calculations and formulas are correctly standardised and not changed

- Different applications hosting various transactions and sub-ledgers need to be reconciled

- Automating reporting tasks and putting in controls and authority levels

- Consolidating multiple company’s information for group reporting

- Producing information in multiple ways to ensure that no one sees information which they should not access

There are many reporting tools in the market where, whilst they do make the process less manual and easier, they are still not able to fully meet all the requirements to optimise and streamline the gathering of financial information.

Based on the above, it’s no wonder individuals approach the finance team with trepidation over month end, after all, if they get any one of the above steps wrong the result to the business could be quite damaging.

Surely, no finance person imagines that after years of studying, their job would entail spending hours on end correcting transactions and preparing data, knowing that by the time it is finished the information is out of date and only scanned briefly by stakeholders. I’m sure they would prefer to spend that time analyzing the information and providing insight into how well the business is doing, as well as provide insight into how the business can improve.

For your finance department to leverage maximum value from your ERP system you should consider the following:

- Each individual in your organisation who creates a source transaction which ends in a financial result needs to be aware of their part.

- Actively encourage process audits, system audits and configuration audits.

- Ensure you have a reporting tool capable of all the requirements needed by the finance team to generate the information business requires quickly and efficiently.

It is possible for your finance team to live up to their expectation of adding value rather than just being data capturers and correctors.