Over the last few decades manufacturing has changed profoundly, in response to factors that include: the opening up of world markets, the economies of Cloud-based computing, and the global adoption of ERP and Industry 4.0 applications. With the strategic introduction of connected, digital technologies, manufacturers open themselves up to enormous rewards – but they also expose their companies to brand new areas of risk.

The Evolution of the CFO

In the old days, the role of the CFO was strictly finance-related. Today, however, the strategic CFO (in harmony with the board of directors) bears a company-wide responsibility for risk mitigation. As a CFO, I’m expected to be data-driven, revenue-focused, and capable of mitigating risk across the entire enterprise.

A typical week could see me vetting commercial arrangements with suppliers, providing mechanisms to mitigate against legal disputes, improving debt collection processes, reviewing pricing structures, as well as countless other tasks. In general, a CFO is expected to provide governance and controls over everything that involves finance, but this can be expanded to operations, strategy, sales, and even human resources.

Sharing the Responsibility of Risk Management

All companies generally have the same risk framework (Strategic, Compliance, Operational, Financial, Reputational) but in manufacturing, there is more emphasis placed on one over another. For example, operational risk is a key area – products may have many sub-processes that need to be configured, operated, monitored and managed, to minimize the risk of failure. This too falls within the responsibilities of the modern CFO.

However, risk avoidance activities are carried out by most department heads. The warehousing manager, for example, owns the risk of housing stock items and ensuring that mechanisms are in place to prevent theft, damage, and obsolescence; while finance ensures that the control framework is derived and set up for the warehousing function to operate within, thus ensuring less risk to the business as a whole. Likewise, the plant manager owns the risk associated with the physical plant and equipment. It’s their job to ensure that safety and health regulations are adhered to. Again, it is finance that makes sure that the control framework is derived and set up for the plant function to minimize risk to the business. Believe me – and I’m speaking from personal experience – all this is a lot of work.

Technology that Manages Risk

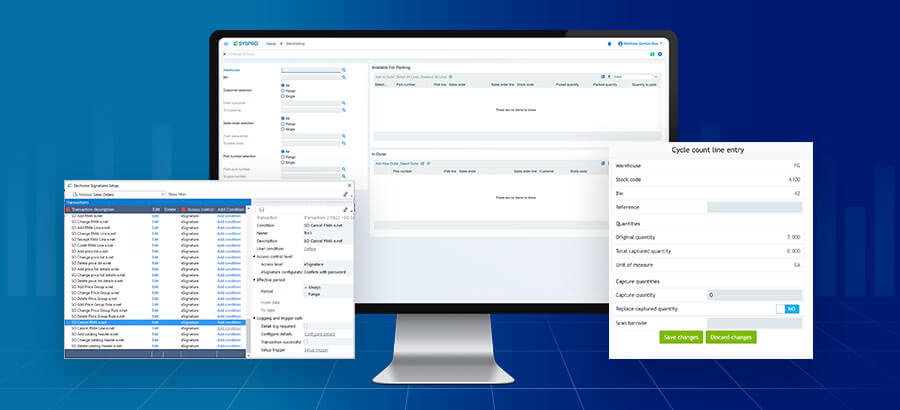

Fortunately, the same technology that informs and inspires our innovative, disruptive, digital business plans can also help us prevent accidents, shut down exploits and put a stop to fraud. In terms of risk mitigation, Industry 4.0 technologies such as machine learning, artificial intelligence, and predictive analytics are quickly becoming the CFO’s best friend.

As I’ve mentioned before, risk mitigation is a data-driven exercise. What, then, could be more useful than artificial intelligence, which can process and analyze structured and unstructured data at a rate beyond the capabilities of even the most dedicated CFO? With an AI integrated to SYSPRO ERP, capable of working overtime, without bathroom breaks or coffee, it is possible, at the end of the day, to feel comfortable that one has mitigated as much risk as is human – and technologically – possible. Industry 4.0 technologies have certainly changed our profession, but they are also a crucial element for ensuring that CFOs everywhere get a sound night’s sleep.

In my next blog, we’ll dig a little deeper into three important areas of AI-backed risk mitigation to which SYSPRO gives special attention: Predictions, Anomaly Detection, and Computer Vision.