At the beginning of 2020, the global market for automotive parts and accessories had enjoyed several years of high margins and steady growth in a stable environment. It was valued at $390 billion, according to a report. Then the COVID pandemic hit, and the once recession-resistant industry took a massive knock. The disruption changed the industry so significantly that it’s likely there won’t be a return to normal. This means automotive parts and accessories businesses must start looking at changing their business model and will need technology to help support the change.

The new normal for automotive

The pandemic has introduced new factors into the automotive market.

- A drastic reduction in vehicle distance travelled, fewer collisions, resulting in reduced demand.

- More unemployed or cashflow strapped drivers delaying their auto maintenance.

- Lower retail traffic but a significant increase in digital channels and e-commerce activity.

- Moving from large truck distribution to increased small vehicle deliveries.

- A changed product mix as well as demand swings upstream in supply chains.

Then there are emerging vehicle technology changes. Electrification requires fewer moving parts, and Advanced Driver Assistance Systems are expected to lower collision rates. This means lower demand as well.

The industry needs to examine how to adapt key elements of the business value chain to address these changes. This will include:

- maximizing profitability in a lower margin environment;

- revamping the product design lifecycle;

- managing new supply chain conditions, which suppliers, shippers or countries can actually supply;

- streamlining inventory to balance stock mix and levels to support customer service;

- upgrading product traceability and returns;

- digitizing the business to address new ways to interact with customers and partners.

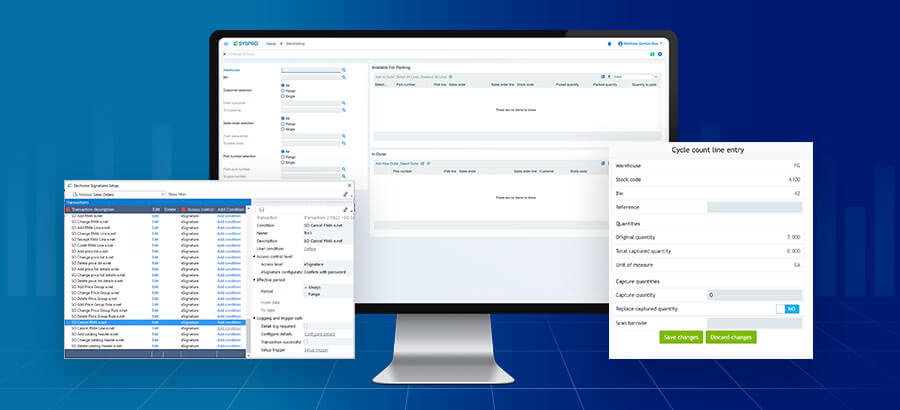

None of these changes can be accomplished successfully without technology. The good news is that there are software solutions that can address all these issues. ERP software has been used and relied on by manufacturing companies for many years, including automotive parts and accessories, and provides solutions that adapt and enable this new business and market situation.

Improve profitability

Reduced and variable demand, vehicle innovations and lower-priced cars are affecting profitability. To remain in business and stay profitable, companies need to ensure that manufacturing processes are as cost-effective and efficient as possible. This requires having visibility of costs across the business so issues can be identified as they occur – such as variations between expected and actual raw material and production costs; obsolete, slow-moving, and excessive inventories; and product defects and scrap.

Control product design lifecycle

Automotive parts and accessories have a significantly shorter product lifecycle due to the evolution of technology and the rate of change in consumer preferences. As a result, manufacturers should be innovative in product design and development as well as automatically downloading updated designs to BOMs (Bill of Material) in their ERP system to ensure correct buying and manufacturing occur.

Companies need to track the introduction of new product designs and amendments to existing designs, along with relevant costings. A manufacturing-oriented ERP solution provides the oversight and controls on product development and ensures through Engineering Change Control that products are manufactured to the correct designs and specifications in the manufacturing process, the ERP application will accommodate complex component and sub-assembly requirements.

Manage the supply chain

Many manufacturers these days rely on global supply chains. But while global supply chains measure shipping and delivery times in weeks and months, customers expect faster deliveries. This makes it a challenge to balance supply and demand effectively. However, the right software tools can help companies deliver a better product to market faster, anticipate demand, as well as build and participate in agile supply chains.

To manage a global supply chain effectively, manufacturers can predictive technology that can handle and analyze the data coming through the supply chain to ensure businesses remain competitive.

Streamline inventory

Inventory can cost a fortune if it is not managed properly. Inventory carrying costs come in different forms and inventory management software brings significant savings through optimizing inventory levels and providing visibility across all warehouses. This includes:

- freeing up cash by effectively planning and ordering raw materials and parts with MRP (Material Requirements Planning) when needed rather than holding just-in-case stock

- ensuring inventory is located in the right place for when manufacturing needs it

- saving costs by reducing obsolete stock and optimizing stock mix to match demand

- streamlining material handling and to save on handling costs and product damage

- Reduction, efficient warehouse space allocation and inventory management you can even save rent

Implementing an ERP system can rapidly realize ROI through visibility into inventory and warehouse management integrated with accounting, manufacturing, and distribution operations. It provides the tools to optimize inventory, increasing customer service and enables the effective planning and control of different product lines in a single or multi-warehouse environment.

Increasingly, manufacturers are looking for digital capabilities to automate processes with data capture using bar-coding and mobile devices, as well as linking to IoT devices, robot location shuttles and others. An ERP system can optimize and facilitate more detailed warehouse management controls such as managing multi-warehouse transfers, bin location parameters, zoning, picking and put-away.

Upgrade warranties and returns

An important aspect of automotive parts and accessories is that customers expect warranties and returns to be part of the deal. Companies must therefore be able to handle warranty claims with full tracking and tracing. There are benefits of investing in an ERP system that controls the reverse logistics, monitors and reduces the risk of defects, and improves customer service.

Digitize business

The last industrial revolution involved the automation of machines and processes. The new wave of industrialization (known as Industry 4.0) integrates the business value chain via digital platforms. The digitization of design, production, delivery, sales and services, as well as integrating partners and other systems that are part of the supply chain, will improve collaboration, planning and execution across an extended value chain.

In the automotive parts and accessories field, consumers are migrating to e-commerce for purchases and including collation of import cost elements. Manufacturers will need to offer this channel to allow customers to make purchases online and then pick them up. An e-commerce portal should integrate to the ERP system with inventory levels updated in real-time, and show inventory information by warehouse location for more delivery precision.

Manage traceability and recalls

According to research by Allianz Insurance released in late 2019, the average value of large recall claims in the automotive industry is $13.78m. The latest recall story involves General Motors recalling 73,000 vehicles due to battery fire problems, at a cost of USD $1 billion which GM plans to claim from its supplier.

That and a spate of other global recalls emphasizes how important traceability and quality control are for manufacturers in the automotive industry. This covers not only the internal design and production environments, but also supplier quality management.

This is where an ERP system offers other important benefits. It can trace each individual part, from the smallest nut to an entire sub-structure, whenever and wherever it is along the supply chain. It will also support existing quality and safety systems, enabling full traceability and managing policies, plans and procedures to handle contingencies to minimize damage.

The way forward

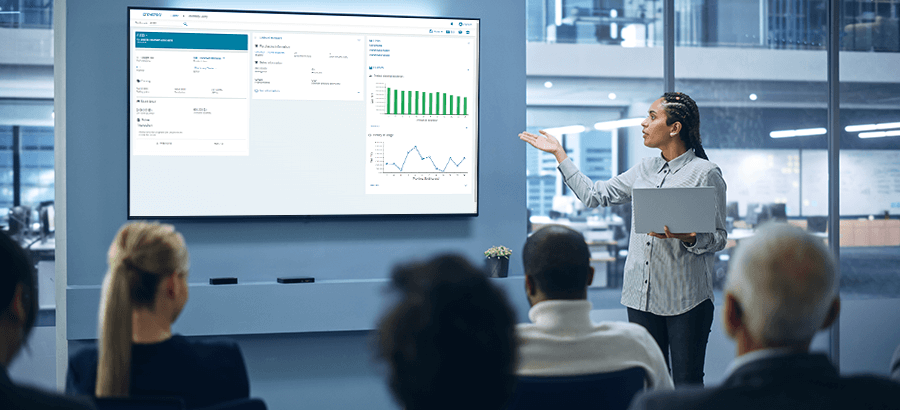

During the remainder of the pandemic, and after, the automotive parts and accessories industry will need to review business models strategies, and processes to adjust to the new changes that will be a permanent fixture in the future. This will involve e-tailing products combined with specific service offers, redesigning sourcing plans, and adjusting to the impact of new vehicle technologies.

By digitizing operations, interactions and channels, new revenue opportunities will be possible. Companies that realize that the path to recovery will require a very different approach, and the deployment of technology, will have a better chance to not only survive but also thrive, especially if they begin now.