If I had ever, in my youth, invented an acronym, I believe it would have been ‘GARR’. GARR represents the repetitive processes that countless financial workers have suffered through since the invention of…well…finance. Finance, almost by definition, requires attention to detail, and for a finance worker, the details are in the data. And if you rely on data, then somebody needs to GARR:

Gather, Analyze, Report, Repeat

GARR probably accounted for the bulk of my work life before the advent of corporate management performance (CPM) software. Much of that is just a memory now – the long hours I used to spend closeted in my office, gathering, analyzing and reporting on financial data, the painstaking attention to cells, columns and rows, the late nights when I struggled to keep my eyes focused on spreadsheets. The days I spent in a waking nightmare, consolidating the complicated financial statements of multiple entities. And, of course, the early mornings when I got up to do it again….

The Power of Automation

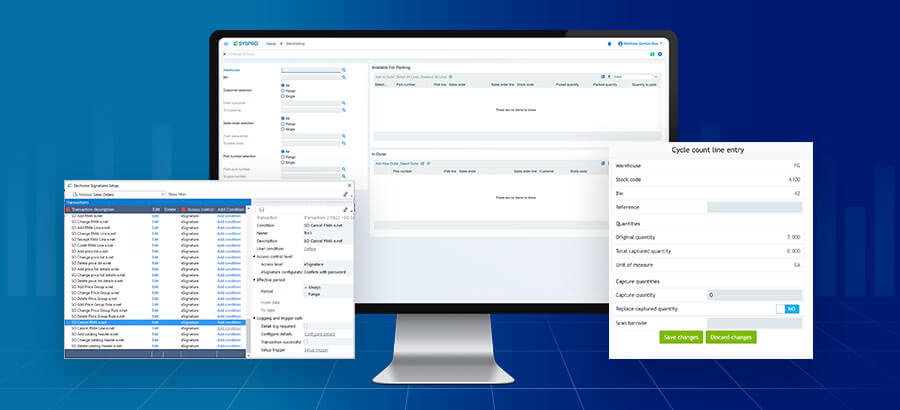

By automating the most repetitive processes within GARR, CPM has made my job more rewarding – I now have extra time to focus on the parts of my work that require actual thought and decision making. For those of you who haven’t had the pleasure of working with a CPM, let’s look at some of its features and advantages.

For companies still using spreadsheets, CPM is almost guaranteed to be transformational. Spreadsheets have worked well-enough for decades, but as we head into the era of Industry-4.0 technologies, their shortcomings are becoming obvious. Financial workers are increasingly being asked to bring their processes into the 21st century, which means supporting business decisions, strategies, critical success factors and market trends with real-time intelligence and analysis. Spreadsheets simply aren’t up to the task: not only are they difficult to integrate with ERP solutions, but they suffer from being error-prone (even the best of us make data-entry errors) and they lack the inherent, feature-rich strengths of modern, collaborative software. They are, in a word, the very essence of repetitive GARR.

The BI of CPM

Once spreadsheets have been kicked to the curb, CPM will do most of the GARR-ing for you, while maintaining (for the sake of your sanity) that old familiar spreadsheet look and feel. This allows an easy transition to increased functionality and collaboration, which ultimately adds up to enhanced productivity for your entire user community.

With CPM in place, you can:

-

Support company business objectives:

By monitoring company performance KPIs (performance measurement) such as revenue, ROI, CAPEX and OPEX, while automating important, but repetitive processes such as data imports, report generation and allocations.

-

Create standardized plans:

By leveraging CPM’s pre-built functionality, you can pre-populate data for the creation of logical and consistent models, budgets, forecasts and cash flow plans.

-

Consolidate multi-divisions, multi-locations, multi-currencies, multi-ERP solutions:

For complex multi-unit or division companies, CPM can easily deal with multiple locations and currencies and can interface with multiple ERP solutions. That makes a real difference when it comes time for reporting, consolidating, and improving the accounting tasks involved in a financial close.

-

Deployed on-premise or in the cloud:

And of course, because it’s integrated with SYSPRO ERP, our CPM solution can be deployed in the way that makes sense for your business – on-premise or in the Cloud. Either way – CPM provides full functionality along with an intuitive, productive, collaborative user experience.

I realize that my acronym (GARR) will most likely never catch on. CPM, however, is already making its presence felt in financial offices, here in Australia, and around the world. If you’d like an obligation-free demonstration, please don’t hesitate to give us a call.